Micro-Enterprise Development Revolving Fund

Micro finance has emerged as a major tool to reduce poverty in many countries as it helped in the creation and expansion of micro enterprises by vulnerable communities. Many MFIs are adopting strategies to deliver micro-finance in sustainable manner but still are dependent on concessional funding for carrying out their operations.

In a Microfinance approach, SHGs are the ultimate beneficiaries. Policies in the country are favourable to banks and other financial institutions for linkages with SHGs but it rarely happens in practice. Therefore, OUTREACH decided to mobilize a micro-enterprise revolving fund, from inside and outside the country in the form of grants and soft loans from banks, apex financial and development institutions.The loans range on the nature of the enterprise.

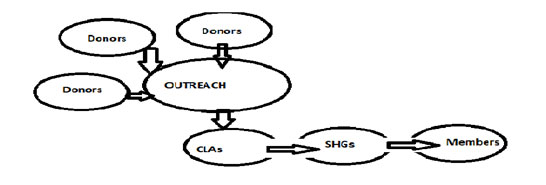

Diagram Illustrating the Process of Lending

The barrowers used the money to meet their short term needs for starting a sustaining enterprises like tailoring, auto repair, carpentry, furniture repair and handlooms in addition to the most popular enterprise–dairying and animal husbandry

OUTREACH lent money to CLAs who in turn identified needy and eligible members among their SHGs for a small service change at all the 3 levels. The total amount thus in circulation during 2010-11 was 241.85 lakhs. However, over the years there has been slackness in its management and a major portion now remains with SHGs as overdue amount.

- So far, 7024 women members from 1148 SHGs have been assisted for income generation / enterprise activities, with an average loan size of Rs.12,700/-(Min RS.1000/- Max Rs.33,000)

- 52 types of enterprises (Land based – 8 & Non-land based – 44) were undertaken by women members.

- 22 OUTREACH staff, 2031 SHGs and CLA members were trained on microfinance, microenterprises, crop insurance and CBO management.